4 Accounting Vouchers — Types

This chapter explains the major voucher types used in Tally Prime and gives clear, step-by-step instructions to create each voucher. Every voucher section contains:

- Purpose of the voucher

- When to use it

- Step-by-step procedure in Tally Prime (with keystrokes)

- A worked example (debit / credit entries)

- Short troubleshooting and tips

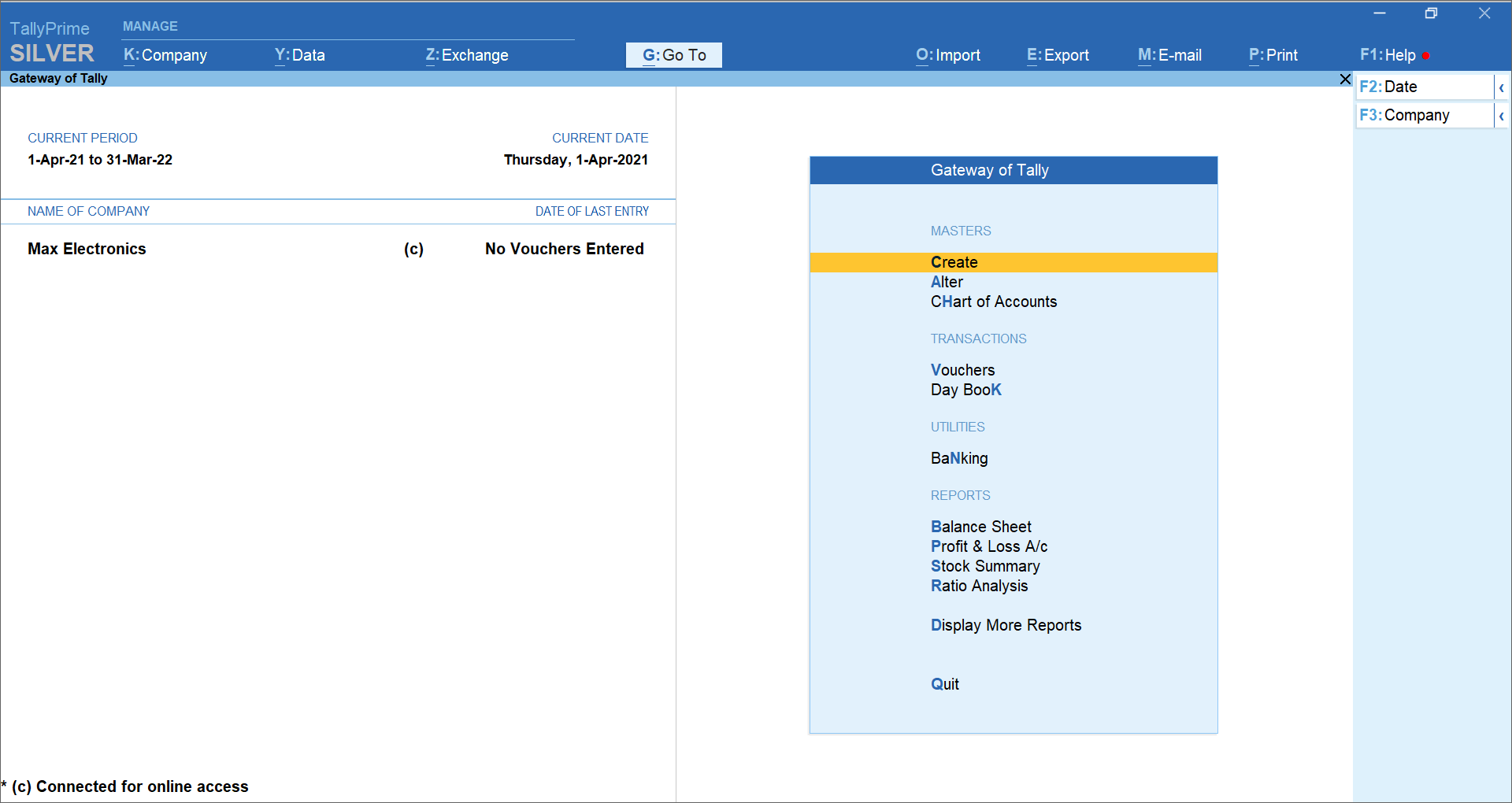

Quick note: Before entering vouchers, ensure you have:

- Selected the correct company.

- Set the correct financial year & date.

- Created required ledgers (Cash, Bank, Debtors, Creditors, Sales, Purchase, Tax ledgers, Expense ledgers, etc.).

- Enabled relevant features (F11 → Accounting Features / F3 → Statutory & Taxation) if taxes are involved.

4.1 Shortcuts used in steps

- Alt + F1 — Select / Shut company

- Alt + F3 — Company Info / Backup (also used to create company)

- V (from Gateway of Tally) or Accounting Vouchers menu → open vouchers list

- F8 — Payment Voucher (default)

- F5 — Payment or Receipt (depends on version) — check your Tally mapping

- F6 — Receipt Voucher

- F7 — Journal Voucher

- F4 — Contra Voucher

- F9 — Purchase Voucher

- F8 / F10 / F11 — Sales / Rejections / Multi-Functions (versions vary)

- Ctrl + A — Accept screen / Save voucher

- Ctrl + R — Repeat narration (where available)

- Alt + R — Toggle round-off (version dependent)

Shortcut keys may vary slightly between Tally Prime releases — always check the voucher menu keys displayed at the top of the voucher screen.

4.2 Contra Voucher (Transfer between Cash/Bank)

Purpose: Transfer of funds between Cash and Bank (e.g., cash deposited to bank, bank cash withdrawal).

When to use: Cash → Bank deposit, Bank → Cash withdrawal, Bank → Bank (transfer between bank accounts).

4.2.1 Steps (Contra)

- Gateway of Tally → Accounting Vouchers → Press F4 (Contra).

- Enter Date (top-left).

- Dr / Cr line 1: Select ledger Bank of India - Current (or target bank), enter amount (this will be Dr if receiving in bank).

- Cr line 2: Select ledger Cash-in-Hand, enter same amount (this will be Cr).

- Alternatively, reverse order depending on how your version shows Dr/Cr. Tally shows the first ledger as Dr by default.

- Alternatively, reverse order depending on how your version shows Dr/Cr. Tally shows the first ledger as Dr by default.

- Add Narration (brief note: “Cash deposit to bank - branch X”).

- Press Ctrl + A to accept and save.

4.3 Payment Voucher

Purpose: Payment made to suppliers, expenses, utilities, wages.

When to use: Paying cash or bank transfers to creditors or expense payments.

4.3.1 Steps (Payment)

- Gateway of Tally → Accounting Vouchers → Press F5 / F8 (Payment — check your version).

- Enter Date.

- In the Pay From ledger (usually top line), select Bank of India - Current or Cash-in-Hand depending on payment mode.

- In the Particulars (opposite) select the ledger being paid (e.g., ABC Suppliers or Electricity Expense).

- Enter Amount and any tax fields (if TDS or TCS applies, enable and fill).

- Add Narration: “Payment to ABC Suppliers for invoice #45”.

- Press Ctrl + A to save.

4.4 Receipt Voucher

Purpose: Receive money — cash sales, receipts from customers, odd receipts.

When to use: Cash received from customers, bank deposits from sales, loans received.

4.5 Journal Voucher

Purpose: Record non-cash adjustments, accruals, depreciation, rectification entries, provisions, closing entries.

When to use: Opening adjustments, accruals, transfer between ledgers where no cash/bank changes happen.

4.6 Sales Voucher (Invoice / Sales Entry)

Purpose: Record sale of goods or services (with or without tax).

When to use: Sales to customers, credit or cash sales, applies GST/Taxes as per settings.

4.6.1 Steps (Sales)

- Gateway of Tally → Accounting Vouchers → Choose Sales Voucher (F8 / F10 depending on setup).

- Enable Use Invoice Mode (if you want item-level invoices) — press F12 / check voucher configuration — choose Invoice mode.

- Enter Date.

- Party A/c name: Select customer (Sundry Debtors).

- Sales ledger: Select

Sales Account(or product-specific sales ledger).

- Inventory items: If in invoice mode, choose item(s), quantity, rate — Tally calculates amount.

- GST / Tax: If GST enabled, Tally will show GST breakup; select tax ledgers for CGST/SGST/IGST as required.

- Check Total, add Narration (invoice reference).

- Press Ctrl + A to accept.

4.6.2 Example (Taxable sale)

- Sale of goods to Ram Traders ₹30,000 (GST 18%):

- Debit: Sundry Debtors — Ram Traders ₹35,400

- Credit: Sales ₹30,000

- Credit: CGST ₹2,700

- Credit: SGST ₹2,700

- Debit: Sundry Debtors — Ram Traders ₹35,400

(Tally will auto-break tax if tax ledgers configured.)

💡 Tip: Use Invoice Mode for GST compliance (invoice numbering, item details). Check customer shipping details & GSTIN before saving.

4.7 Purchase Voucher

Purpose: Record purchases from suppliers (credit or cash purchases), with taxes.

When to use: Purchase of goods or services from vendors.

4.7.1 Steps (Purchase)

- Gateway of Tally → Accounting Vouchers → Press F9 (Purchase).

- Enter Date.

- Party A/c name: Select supplier (Sundry Creditors).

- Purchase ledger: Choose purchases ledger (or item-specific).

- Enter items, quantity, rate (invoice mode recommended).

- GST / Tax: Ensure GST is properly applied (Tally splits tax amounts).

- Add Narration and Bill-wise details if using credit (for payment terms).

- Press Ctrl + A.

4.8 Credit Note (Sales Return / Credit Memo)

Purpose: To record returns or credit given to customers against earlier sales.

When to use: Customer returns goods, adjustment of invoices, price corrections.

4.8.1 Steps (Credit Note)

- Gateway of Tally → Accounting Vouchers → Choose Credit Note (under Sales Vouchers or special voucher).

- Enter Date and Party (customer).

- Select Sales Return ledger or use negative quantity in invoice mode.

- Enter returned items / amounts.

- Tally will adjust tax ledgers accordingly.

- Press Ctrl + A to save.

4.9 Debit Note (Purchase Return / Debit Memo)

Purpose: To record return of goods to suppliers or debits from supplier for price corrections.

When to use: You return items to supplier or supplier issues a debit note.

4.10 Additional Practical Notes

4.10.1 Bill-wise details for credit transactions

When making sales/purchase on credit, use Bill-wise details to: - Record invoice numbers - Record due dates - Track aging and collections

Path: In voucher screen, press F2 / check the bill-wise field and enter invoice number and due date.

4.10.2 Voucher numbering & series

- Configure voucher numbering in F11 → Accounting Features or voucher configuration to auto-number invoices and vouchers.

- For compliance, ensure Sales/Purchase invoices are sequential.

4.11 Illustration

- Company starts business — Capital introduced ₹1,00,000 (Journal)

- Dr Cash-in-Hand ₹1,00,000

- Cr Capital Account ₹1,00,000

- Dr Cash-in-Hand ₹1,00,000

- Deposit ₹50,000 into Canara bank (Contra)

- Dr Bank ₹50,000

- Cr Cash ₹50,000

- Dr Bank ₹50,000

- Purchase goods on credit from ABC Suppliers ₹30,000 (Purchase)

- Dr Purchases ₹30,000

- Cr Sundry Creditors — ABC Suppliers ₹30,000

- Dr Purchases ₹30,000

- Goods returned to ABC Suppliers ₹3,000 (Purchase Return / Debit Note)

- Dr Sundry Creditors — ABC Suppliers ₹3,000

- Cr Purchase Return ₹3,000

- Dr Sundry Creditors — ABC Suppliers ₹3,000

- Make a payment to ABC Suppliers ₹15,000 (Payment)

- Dr Sundry Creditors — ABC Suppliers ₹15,000

- Cr Bank ₹15,000

- Dr Sundry Creditors — ABC Suppliers ₹15,000

- Make sales to Ram Traders on credit ₹20,000 (Sales)

- Dr Sundry Debtors — Ram Traders ₹20,000

- Cr Sales ₹20,000

- Dr Sundry Debtors — Ram Traders ₹20,000

- Ram Traders returned goods ₹2,000 (Sales return / Credit Note)

- Dr Sales Return ₹2,000

- Cr Sundry Debtors — Ram Traders ₹2,000

- Dr Sales Return ₹2,000

- Ram Traders pays ₹18,000 by cash (Receipt)

- Dr Cash ₹18,000

- Cr Sundry Debtors — Ram Traders ₹20,000

- Dr Cash ₹18,000

4.13 Voucher - Shortcuts

| Voucher Type | Use | Typical Shortcut |

|---|---|---|

| Contra | Cash/Bank transfers | F4 |

| Payment | Payments to suppliers/expenses | F5 / F8 |

| Receipt | Cash receipts / customer payments | F6 |

| Journal | Adjustments / non-cash entries | F7 |

| Sales | Sales invoices (taxable) | F8 / Sales key |

| Purchase | Purchase invoices | F9 |

| Credit Note | Sales returns / credit to customer | (Sales menu) |

| Debit Note | Purchase returns / debit from supplier | (Purchase menu) |